- The following is a summary of the report

- I. Text model trends (chats, writing, code assistants)

- II, , the reasoning model (better solve complex problems)

- # growth:

- Who’s lost?

- III. Image generation (AI drawing)

- The new hotspot:

- Four, # # # video generation (AI making video)

- V, audio generation (text to voice, TTS)

- Who’s the most popular?

- Full report translation

Poe released data on its chat robotic platform for the first half of January-May 2025, revealing the main trends in the use of the AI model in the spring of 2025 by analysing data on the real use of cross-models on its platform. The report highlights the dynamic nature of the model selection, showing many changes and technological evolutions in the areas of text reasoning, image/video generation, audio TTS.

-

** The rapid rise of the reasoning model**: multiple laboratories have evolved at a faster pace, promoting the reasoning model to become a new competitive high ground.

-

** Image and video generation towards diversity**: In particular, the entry of Chinese manufacturers is reshaping the market.

-

** Audio generation is still at the primary stage of the game** and Eleven Labs continues to be an absolute advantage.

The following is a summary of the report

I. Text model trends (chats, writing, code assistants)

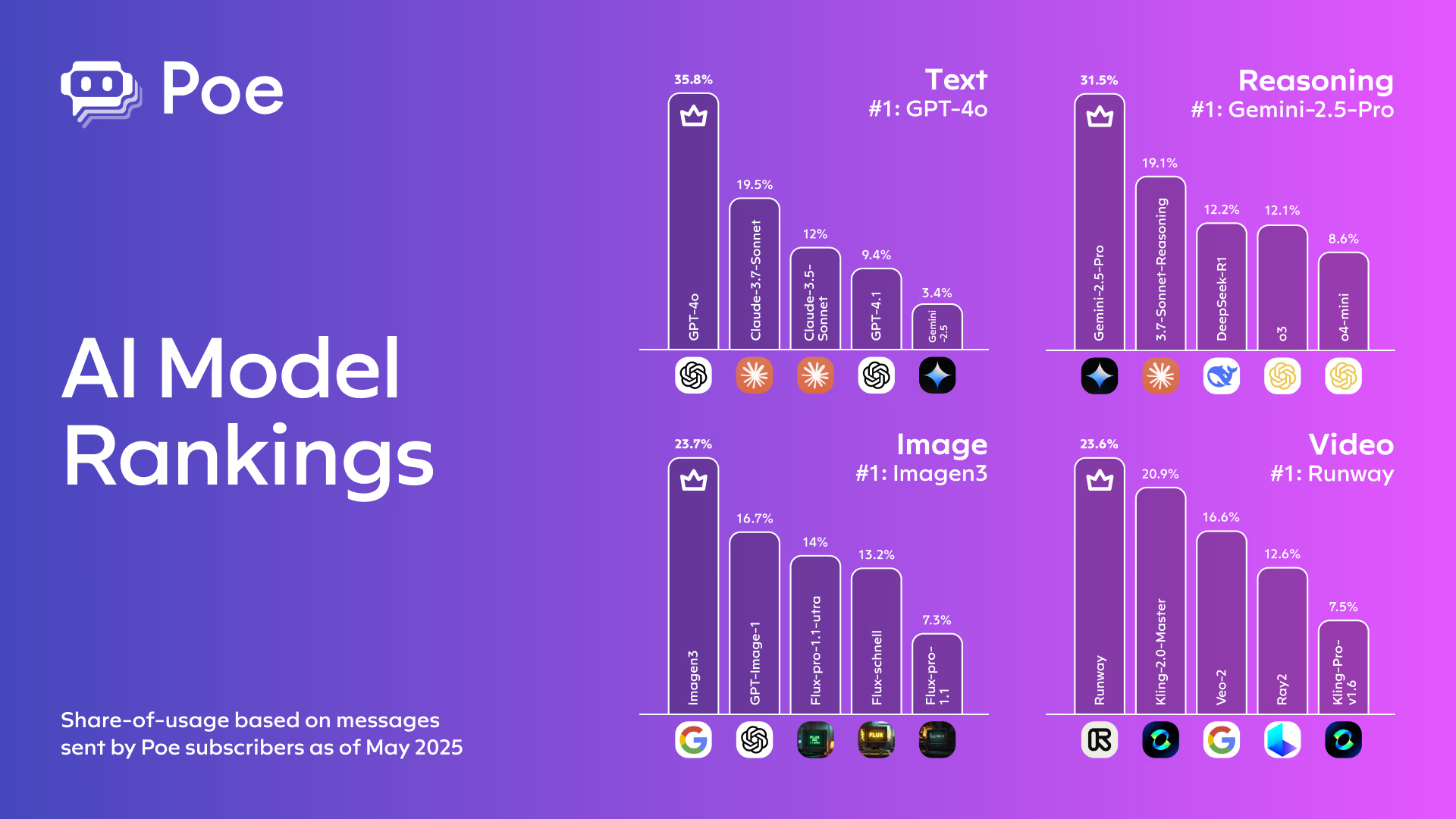

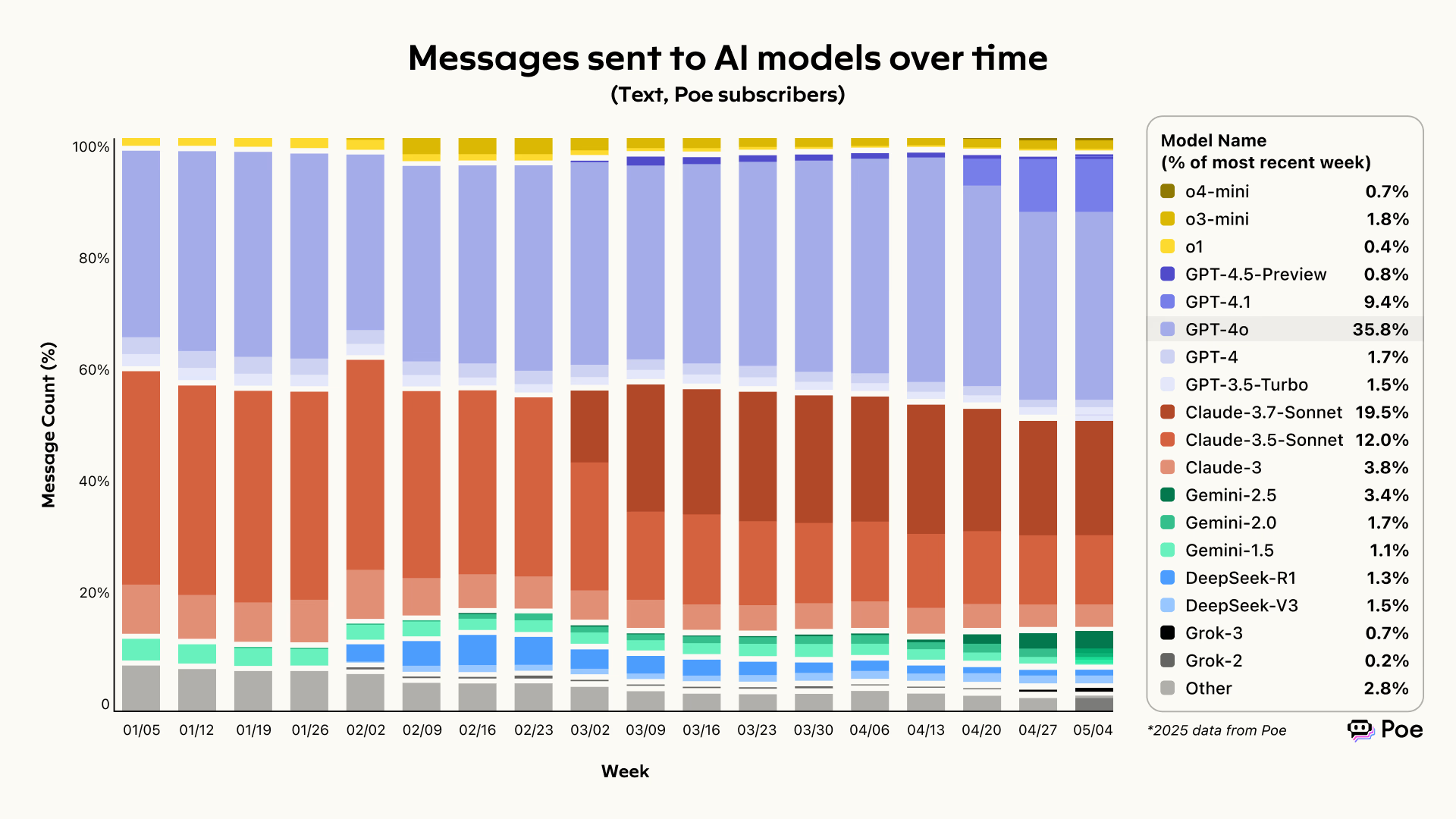

Trends I: Models of OpenAI and Google are becoming more popular

-

OpenAI’s GPT-4.1 series rapidly occupied about 10% of usage within weeks of its release.

-

Gemini 2.5 Pro** of **Google also reached **5% ** and continued to grow.

This suggests that users prefer new, powerful and more responsive models.

Trends II: Old models are gradually being replaced

-

For example, Claude 3.5 of Anthropic was replaced by Claude 3.7, but overall use decreased by about 10%.

-

A model of DeepSeek, once rededicated by “viral transmission”, was reduced by half after a few months.

** Summary**: Users prefer the latest version of the model, and the old model is slowly being phased out even though it is still available.

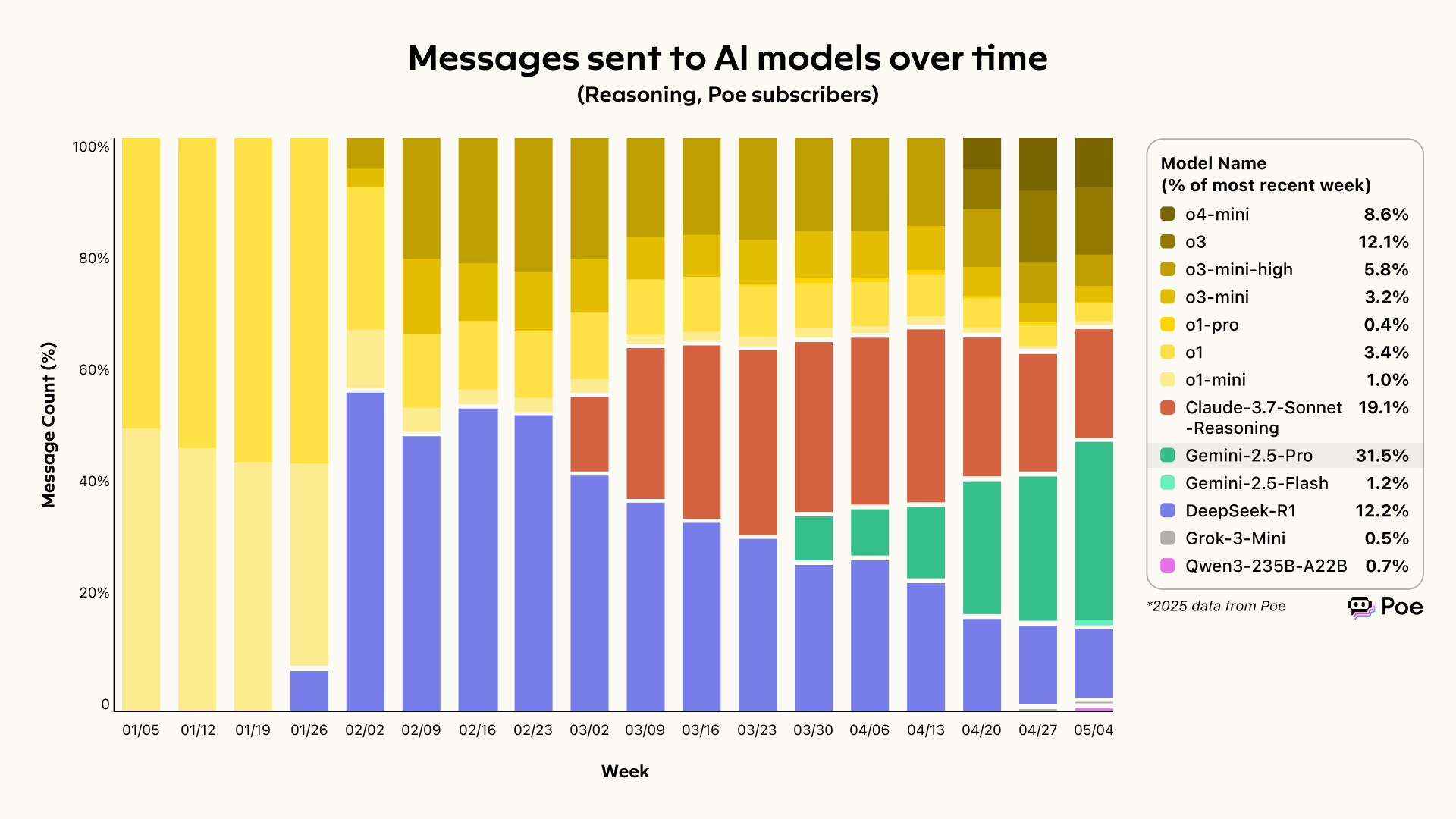

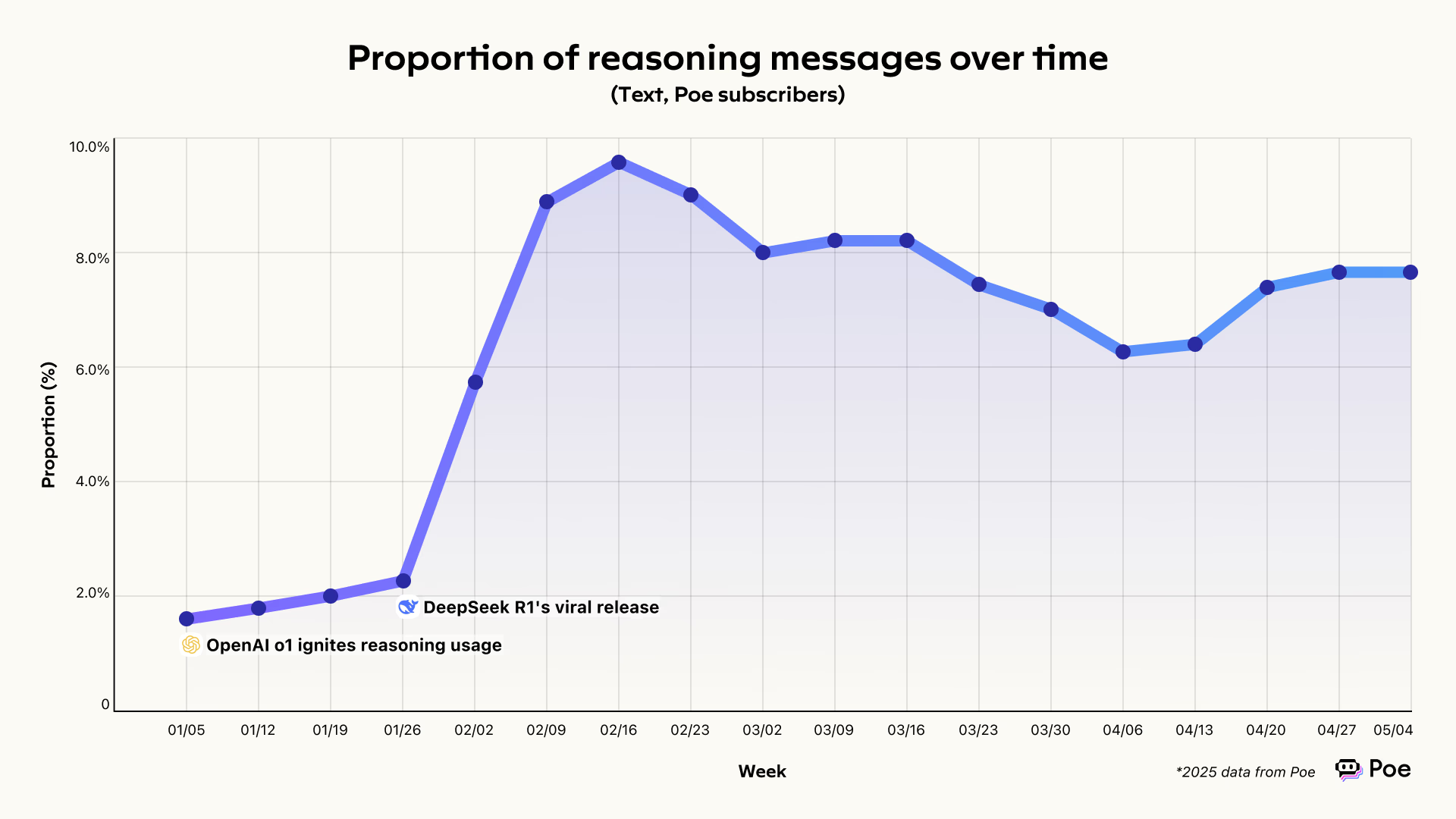

II, , the reasoning model (better solve complex problems)

Such models are increasingly popular as they allow for more in-depth thinking and answers to complex logical questions.

# growth:

-

At the beginning of 2025, the ratio using the reasoning model was 2 per cent and by May it had risen to 10 per cent.

-

Gemini 2.5 Pro Very prominent in reasoning, with 30% of the use of the reasoned task taken in just six weeks.

-

OpenAI disseminates several new reasoning models (e.g. o3, o4-mini) and the user quickly migrates to the new version.

Who’s lost?

-

Elon Musk under Grok-3-mini, although technically strong, has less than **1% ** due to access restrictions.

-

Some mixed models (which can automatically adjust the depth of thought) are novel but less used by users.

** Summary**: The ability to reason is emerging as a new competition focus for the AI model, with OpenAI and Google now leading.

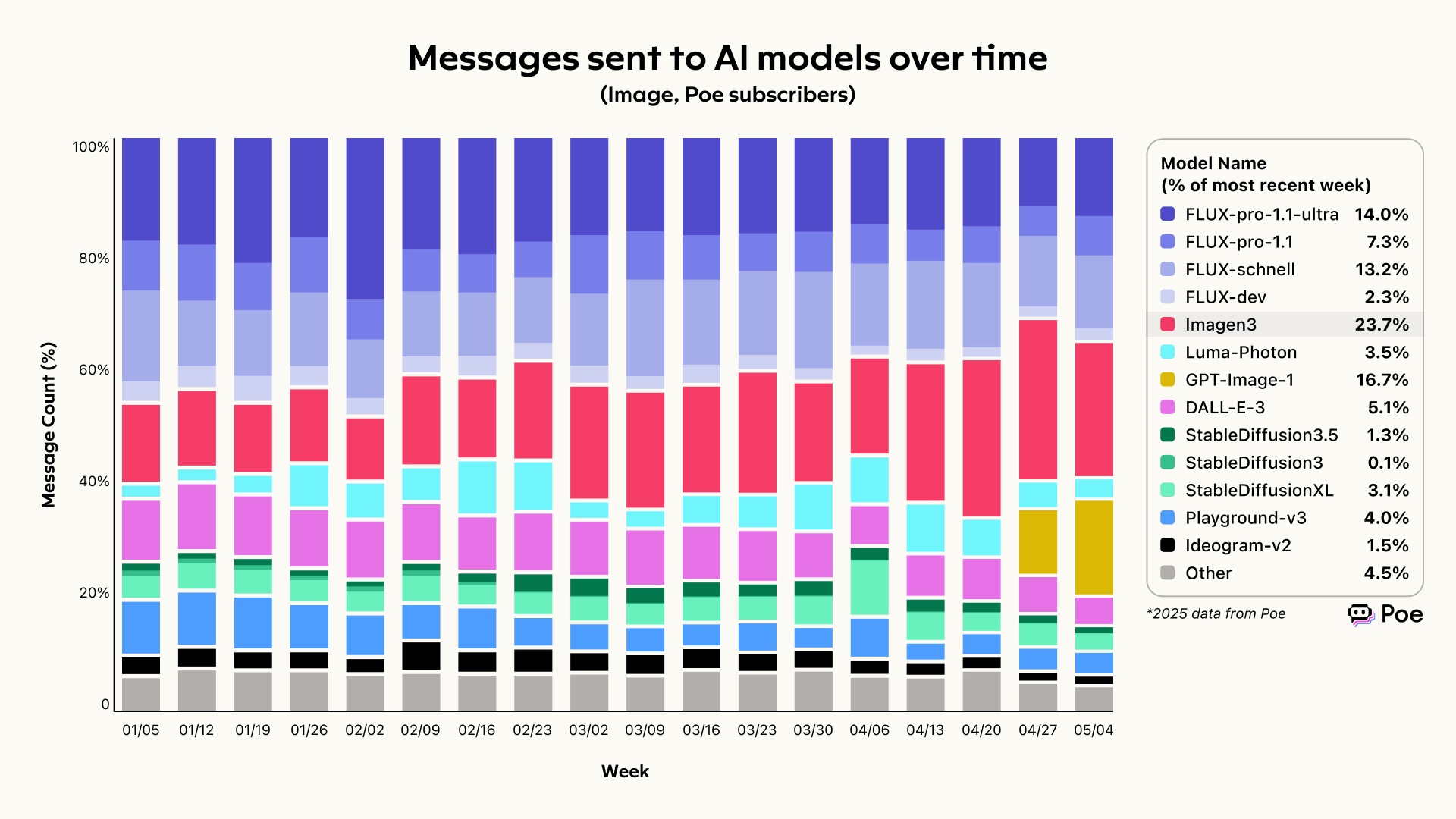

III. Image generation (AI drawing)

Not only is text chat popular, AI’s drawings are becoming more popular and of increasing quality.

The new hotspot:

-

GPT-Image-1 (OpenAI) was launched in April and took away 17% of image generation usage in only two weeks.

-

The Imagen 3 series ** of **Google has grown steadily, from 10 to 30 per cent.

Who’s the boss?

- FLUX series (Black Forest Laboratory) long-standing leader with a current share of about 35%, slightly declining.

** Summary**: New players are constantly joining, and the area of image generation is highly competitive, but users also have more high-quality choices.

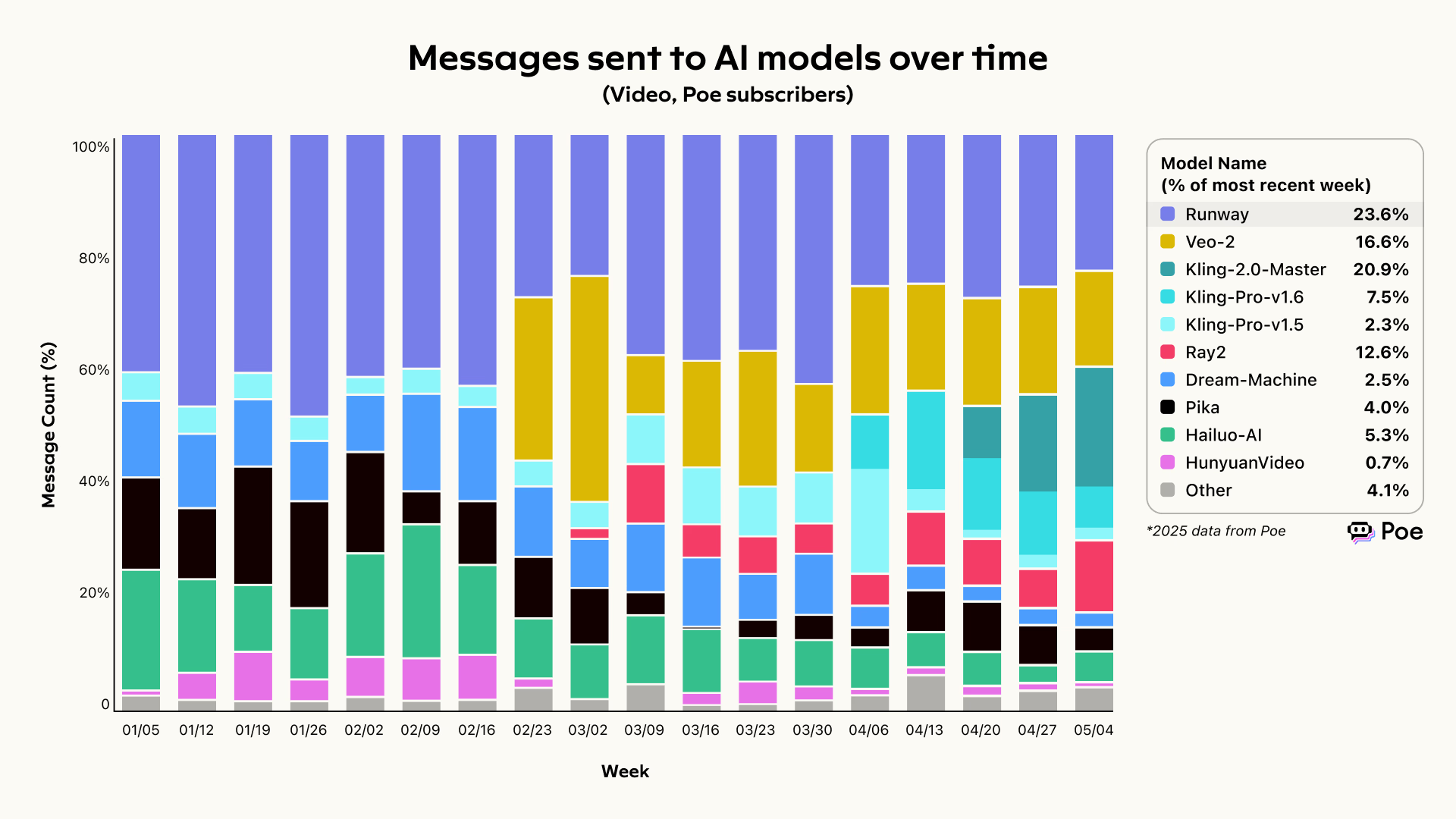

Four, # # # video generation (AI making video)

AI can not only draw pictures, but also generate short videos.

♪ ♪ Bang, bang, bang, bang, bang ♪

Kling 2.0 of Chinese companies, which in only three weeks accounted for 21% of video production on Poe and user feedback was very good.

-

Google Veo 2 also showed steady performance at 20%.

-

The share of the previous leading video model Runway dropped from 40% to 20%, apparently squeezed by new players.

** Summary**: The AI video tool is developing very rapidly, and Chinese companies are beginning to dominate the global market.

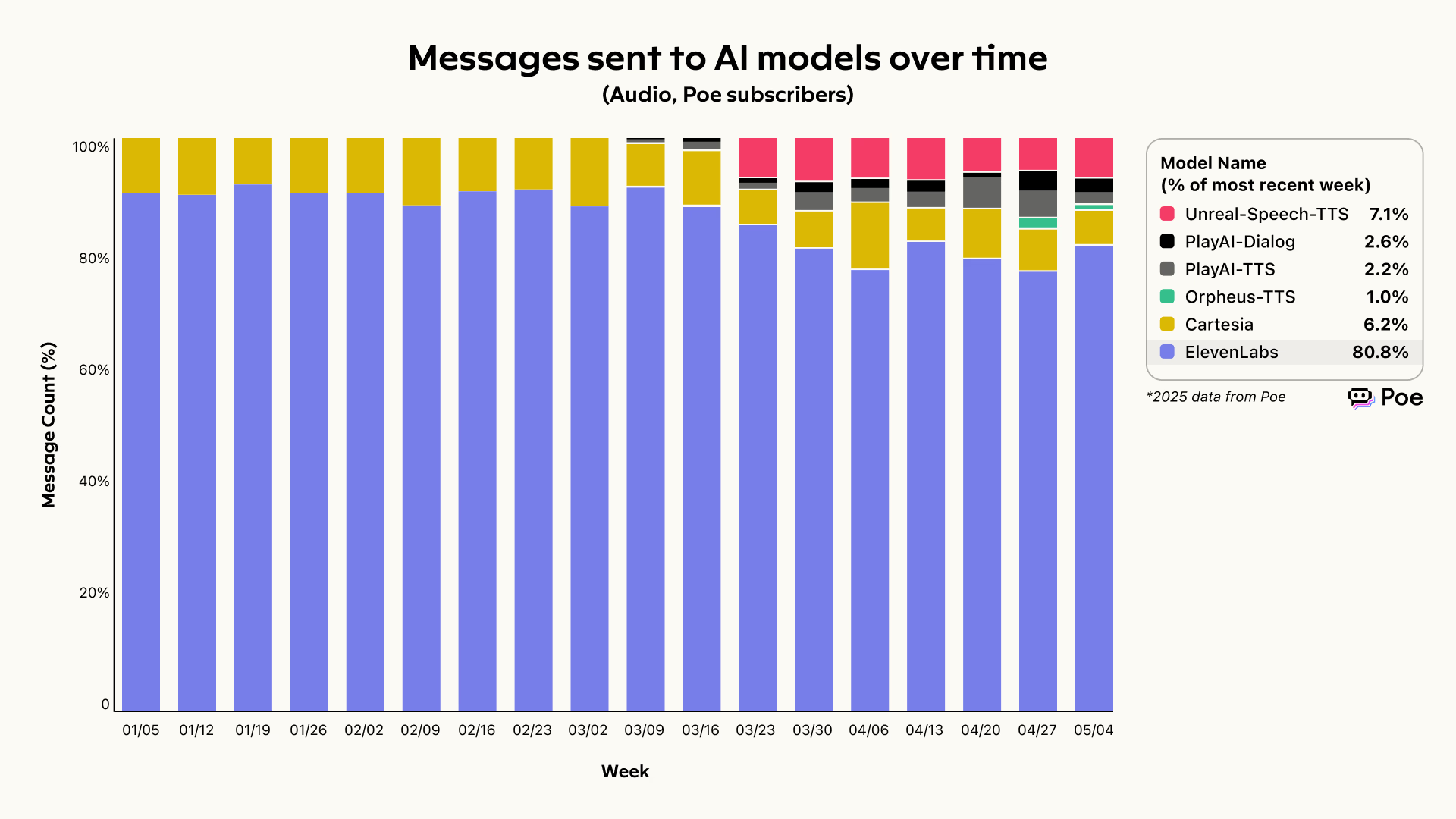

V, audio generation (text to voice, TTS)

AI can also turn your typing into an emotional voice.

Who’s the most popular?

-

ElevenLabs is currently the most popular audio production service, accounting for 80% of the use.

-

New companies like UnrealSpeech, Cartesia, PlayAI are trying to rob markets with different sound styles and prices.

** Summary**: Although Eleven Labs is now a unique family, competitors are slowly emerging.

Full report translation

Artificial intelligence patterns are evolving at an unprecedented pace, but understanding needs and usage patterns beyond standardized benchmarks or high-level platforms remains a challenge. At the same time, a week-long preferred model may be rapidly changed by powerful forward providers or unexpected spoilers.

Our goal is to make Poe the best place to explore, compare and use AI model output. As Poe users access the latest front-line models in a non-provider-related way, potential trends may portend broader changes in AI ecosystems.

Based on our previous report, this analysis shows weekly aggregates of Poe users in several key but expanding areas between January 2025 and May 2025: text, reasoning, images, videos and audio. This includes the continued growth of reasoning models after DeepSeek’s viral moment, the growing competitiveness of image and video generation, and early signs of audio diversity.

We hope that our latest findings will provide researchers and the public with useful insights into rapidly expanding artificial intelligence ecosystems. [1] [2]

** Rapid release of more intelligent generic text models by front-line laboratories**

-

OpenAI ‘ s GPT-4.1 series and Google ‘ s Gemini 2.5 Pro provided an improved performance in real-world programming missions, with the share of news rapidly increasing to ~10 per cent and ~5 per cent in the weeks following its launch.

-

The Claude Series of Anthropic (e.g. Claude 3.5 Sonnet and Claude 3.7 Sonnet) witnessed ~10 per cent decline in absolute shares during the same period.

-

DeepSeek ‘ s viral moment appears to have diminished, as other price-reasonable and lengthy reasoning models have been published successively, and the share of DeepSeek R1 messages has declined from a peak of 7 per cent in mid-February to 3 per cent at the end of April.

-

Similar to the findings in the previous report, the individual provider’s flagship model appears to be devouring its predecessor. In this case, the Poe subscriber quickly accepted Claude-3.7-Sonnet, while Claude-3.5-Sonnet still retains an overall usage rate of about 12% in the large language model.

** The reasoning model continues to be used after DeepSeek entered the virus earlier this year**

-

The use of Gemini 2.5 Pro among Poe subscribers is growing rapidly, and the model received a share of ~30 per cent of the reasoning information within ~6 weeks of publication.

-

OpenAI, after issuing the reasoning model for defining categories at the end of 2024, continued to publish stronger and price-reasonable reasoning models at an unparalleled rate, launching o1-pro, o3-mini, o3-mini-high, o3, and o4-mini in the four months prior to 2025. In OpenAI’s reasoning model, subscribers seem to be rapidly adopting the latest models (e.g. o3-mini o4-mini, o1o3).

-

Despite the fact that XAI’s Grok 3 was among the top of the benchmarks for the resolution of problems in its public release in February 2025, Grok-3-mini remains the only model in the series that supports the reasoning in xAI API, which may explain the fact that it accounts for less than 1 per cent of the use of the reasoning model.

-

We note that the early emergence of hybrid reasoning models, such as Gemini 2.5 Flash Preview and Qwen 3, can make decisions (or controllable) based on changing the level of reasoning in the dialogue (i.e. not only through API parameters). However, their common use in this subcategory is still very small, at about 1 per cent.

** Image generation is becoming increasingly competitive with improved quality and conformity**

-

GPT image generation (GPT-Image-1) was rolled out in API in late April and quickly achieved 17 per cent of image generation usage in just two weeks, reflecting its roll-out of viruses in the ChatGPT application in March and early April.

-

Google’s Imogen 3 family grew steadily in 2025, from ~10% to ~30%, paralleling the FLUX family image-generation model of the class leader Black Forest Laboratory, whose overall occupancy rate in the last week of April was about ~35%.

-

The FLUX family of image-generation models maintained their total share of the total image-generation share of Poe, but slightly decreased from ~45% to ~35% during the reporting period.

** Kling 2.0 quickly became a strong competitor of video generation in just three weeks.** [4]

- The Kling family video-generation model released by Chinese laboratories quickly obtained about ~30 per cent of the use, in particular Kling-2.0-Master, which produced 21 per cent of all Poe ‘ s video production three weeks after its release in late April 2025.*

Google Veo 2 maintained a strong use share of about 20% in the months following its launch in February.

- The defined category of video generation pioneer Runway, whose share of video generation usage decreased by about 40 per cent to about 20 per cent during the reporting period.[5]

ElevenLabs kept leading in audio generation, although early signs of competition are rising [6]

-

In audio generation (especially text-to-speak, or “TTS”), it appears that EvenLabs is favoured by users and has met the TTS requests of about 80 per cent of all subscribers during the reporting period.

-

However, competition is increasing in this area with emerging competitors such as Cartesia, Unreal Speech, PlayAI and Orpheus, which provide unique voice options, voice effects and different performances and price structures.

** Conclusions** We want to share data from Poe’s diverse user base and official integration, providing valuable practical perspectives on dynamic and evolving artificial intelligence patterns. The diversity of models and increased competition among providers help to highlight the value of our platforms, both for users and creators. We look forward to continuing to share these important insights while capturing signs of new patterns and emerging trends. Finally, if you want to experience a library of more than 100 official models, you can register on Poe today at https://poe.com/. ** Remarks** [1] All user information is treated in accordance with Poe ‘ s privacy policy, which explicitly prohibits model providers from submitting any input through Poe for training purposes. [2] We welcome any comment/criticism about our methodology. All the data displays are based on Poe subscribers. Each bar in the chart represents a week of data, from Monday to Sunday. All charts are standardized as a percentage share to control the growth of subscribers over time. During the reporting period, model point prices may change, which may affect use. For text model analysis, messages sent to Poe assistant robots are excluded to reflect the clear user preferences/needs-driven spirit associated with naming models. [3] In the text share map, GPT-4.1 includes GPT-4.1, GPT-4.1-mini and GPT-4.1-nano; GPT-4o includes GPT-4o, ChatGPT-4o-update and GPT-4o-mini; GPT-4 includes GPT-4-class and GPT-4-turbo; o1 includes o1, o1-prospect and o1-mini; o3 includes o3, o3-mini and o3-mini-high; Claude-3.7-Sonnet includes all messages sent to Claude-3.7-Sonnet and Claude-3.7-Sonnet-turret (regardless of the reasoning effort), whereas in the reasoning category the delineator must be set to be non-zero; Gemini-2.5, including its Pro and Flashet; Gmini-3-Gushini-Gremsheni-Gheni-Gremshu-Grek; [4] Video generation triggered by Poe ‘s animated buttons and other follow-up operations is excluded here to best reflect the user ‘ s preferences/needs pull spirit. [5] As of the time of publication, the Runway robot on Poe continues to serve the Gen-3-Alpha-Turbo API endpoint and has not been upgraded to the Gen-4-Alpha-Turbo endpoint. [6] Audio generation triggered by Poe ‘s talking buttons and other follow-up operations is excluded here to best reflect the user ‘ s preferences/needs pull spirit.