No one really expected

Just after the opening of the US stock market yesterday, the stock price of traditional database company Oracle skyrocketed by 43%. Although it fell back during the trading session, it still closed up nearly 36%, breaking multiple US stock price records.

At one point, he even elevated the 81 year old founder of Oracle, Larry Ellison, to the position of the world’s richest man.

Ellison’s net worth skyrocketed by $100 billion overnight, reaching a total of $393 billion, and (briefly) surpassing Musk’s $385 billion.

Moreover, what’s even more interesting is that the surge in Oracle’s stock price is not driven by its traditional advantage in breaking through its database business.

The credit is still the popular trend of AI, and the credit is that Musk has loved and hated OpenAI, which is still in litigation.

Oracle has disclosed a $300 billion computing power procurement agreement with OpenAI.

This is also one of the largest cloud computing contracts in the world.

Insiders revealed that the agreement will come into effect in 2027, and OpenAI plans to purchase in batches over about five years, with an average annual payment of up to $60 billion.

##Part of the Stargate Project

In fact, Oracle hinted at this deal as early as June in a document, stating that it had reached a cloud service agreement that would bring in over $30 billion in revenue annually from 2027 onwards.

This contract is a high-risk gamble for both companies.

According to the agreement, OpenAI will pay Oracle an average of $60 billion per year, but according to its disclosed data in June, the company’s annual revenue is only about $10 billion, which is less than one-fifth of the average annual payment amount.

OpenAI’s capital consumption rate is almost unparalleled among global startups. Last year, Ultraman told investors that OpenAI would not achieve profitability until 2029, and it is expected to accumulate losses of $44 billion before that.

The feasibility of the protocol is based on the continued explosive growth momentum of ChatGPT, which can not only attract billions of users worldwide but also gain widespread adoption by large enterprises.

The pressure on OpenAI is not limited to these: the intense competition for talent is costly, negotiations with Microsoft are tense, and the restructuring of its profit structure is also under regulatory review.

It is worth mentioning that in order to solve the problem of computing power, OpenAI and one of its largest shareholders, SoftBank, jointly led the launch of a data center project called Stargate * at the beginning of the year, which aims to establish multiple data centers in the United States, known as the “largest artificial intelligence infrastructure project in history”.

OpenAI later stated that Stargate would become the unified brand for all of its data center plans, and this contract with Oracle was part of the Stargate project.

In fact, Ultraman also announced a 4.5 gigawatt data center agreement with Oracle in July, but did not disclose the total contract amount or more details at that time.

Interestingly, at almost the same time, OpenAI was revealed to be seeking a new round of $40 billion in funding. It is said that SoftBank and OpenAI have conflicts over project location and scale. SoftBank has stated that if OpenAI does not restructure, they will reduce their investment.

##Crazy bets on AI infrastructure

On the other side of the oracle bone script, the pressure is not small at all.

After signing this huge agreement, Oracle not only has to bet a significant portion of its future revenue on a single customer, but may also have to resort to borrowing due to the procurement of AI chips needed for data centers.

According to reports, Oracle is partnering with data center builders such as Crusoe to lay out new data centers in Wyoming, Pennsylvania, Texas, and other locations.

To fulfill this contract, electricity alone needs to have a power supply capacity of 4.5 gigawatts. What concept? The scale is equivalent to the total power generation of two or more Hoover dams, or the annual electricity consumption of approximately 4 million households.

Compared to AI investment giants such as Microsoft, Amazon, and Meta, Oracle’s debt pressure and cash reserves are clearly imbalanced. According to data from S&P Global Market Intelligence, Oracle’s investment in keeping up with the AI boom has exceeded its own cash flow level.

Comparing two sets of key data is more intuitive:

Microsoft’s total debt to equity ratio is 32.7%, while Oracle’s is 427%;

As of the fiscal year ending in June, Microsoft’s operating cash flow was approximately $136 billion and capital expenditures (including leases) were $88 billion; However, in the 12 months ending in August, Oracle’s operating cash flow was only $21.5 billion, while its capital expenditures were as high as $27.4 billion.

Behind these data is the industry trend driven by the explosive demand for AI computing power. Technology companies are continuously increasing their investment in the procurement and construction of core hardware and data center supporting facilities to build the hardware foundation required for AI operation.

According to Morgan Stanley’s forecast, the global investment in chip, server, and data center infrastructure will reach $2.9 trillion from this year until 2028.

Such a huge investment far exceeds the financial carrying capacity of most technology companies, not only Oracle, but also many enterprises have begun to turn to the external debt market for financial support. The size of this market is constantly expanding and its potential is significant, even being compared to the “modern gold rush” by Wall Street financial practitioners.

One More Thing

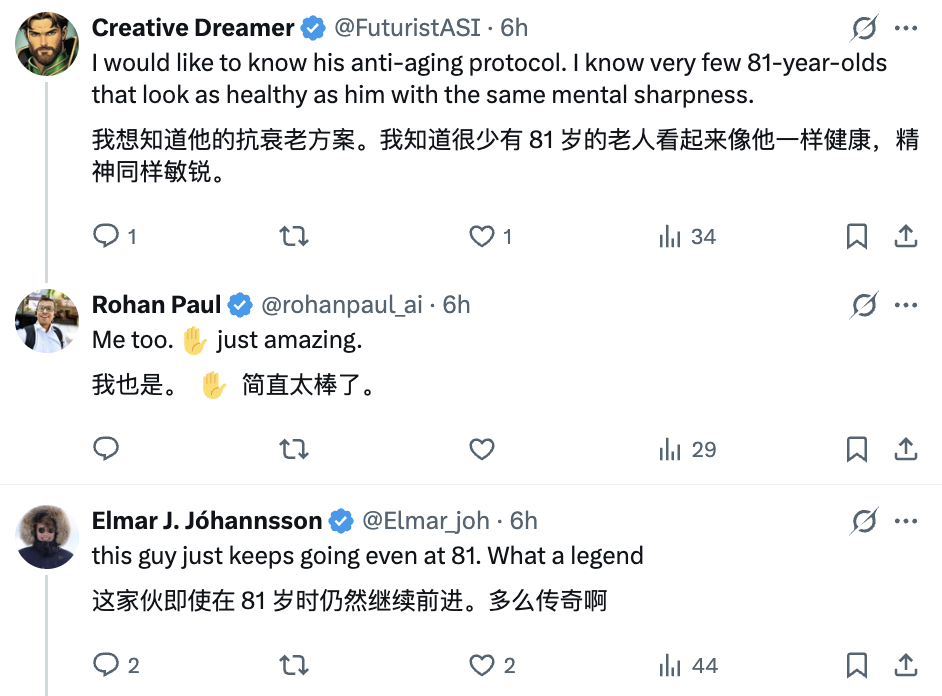

However, as soon as the news came out, netizens were more focused on Ellison’s peripheral gossip - not the one with the young Chinese partner.

Mainly, at the age of 81, how does Larry Ellison resist aging?

Indeed, who would have thought that an 81 year old person doesn’t look like an old person at all.

Is it because the smell of old money is too strong?

Reference link:

[1] https://x.com/rohanpaul_ai/status/1965887164887056667

[2] https://www.businessinsider.com/larry-ellison-net-worth-elon-musk-richest-person-oracle-stock-2025-9

[3] https://www.theverge.com/ai-artificial-intelligence/776170/oracle-openai-300-billion-contract-project-stargate